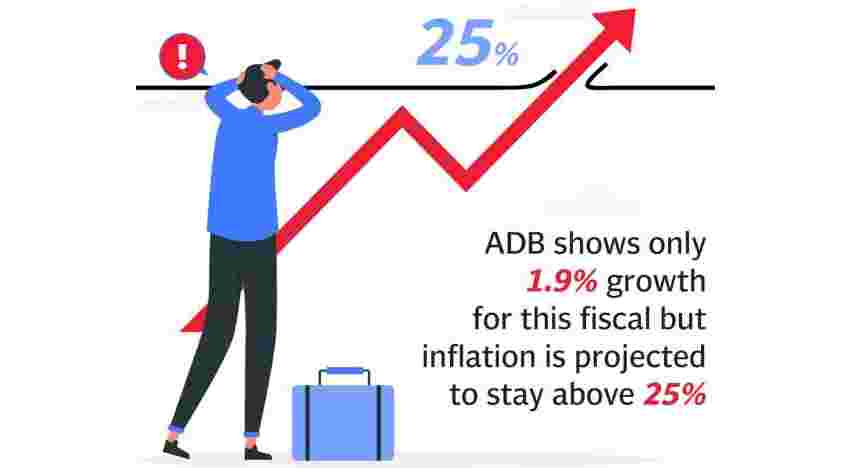

Aligns with ADB highlighting Pakistan as having highest inflation rate in Asia

ISLAMABAD:

The government, on Thursday, projected a significant increase in the inflation rate for September, expecting it to reach 31% due to rising electricity and fuel prices. This forecast aligns with recent global publications that have highlighted Pakistan as having the highest inflation rate in Asia.

In its monthly economic outlook, the Ministry of Finance stated that inflation “in September 2023 is expected to be around 29% to 31%.” This projection, as indicated in the report by the economic advisor wing, marks a reversal of the recent downward trend in inflation. In August, inflation had settled at 27.4% after peaking at 38% in the last fiscal year.

Earlier this month, the Asian Development Outlook, the flagship publication of the Asian Development Bank, projected an average inflation rate of 25% for Pakistan in the current fiscal year. This projection positions Pakistan’s inflation rate as the highest among all Asian economies, despite having the fourth-lowest economic growth rate.

The finance ministry stated that the upward adjustment in energy tariffs is likely to further intensify inflationary pressures in the coming months, as these price adjustments are expected to place an additional burden on transportation costs, essential items, and services. Consequently, inflation is anticipated to remain high in the coming month, exacerbated by a significant increase in fuel prices this month.

The Pakistan Bureau of Statistics (PBS) is expected to announce the official inflation reading for September on Monday.

Despite the government’s inflation target set at 21%, it is expected to be missed by a wide margin due to higher inflationary pressures.

The ministry’s report highlighted that the State Bank of Pakistan (SBP) has maintained the policy rate at the previous level due to anchored inflationary expectations. While the double-digit base effect provides some relief to September’s inflation, its impact appears minimised due to the substantial increase in fuel prices in September 2023, it added.

Although international food prices saw some decline last month, this reduction offset the impact of rising rice and sugar prices.

The ministry stated that the government’s strict administrative actions against unlawful foreign exchange dealers and commodity market hoarders are stabilising the exchange rate, providing relief from imported inflation, and easing commodity prices. However, international crude oil prices are heading toward $100 per barrel in the short term.

The report also mentioned a risk to the cotton crop due to pest attacks, but it noted that cotton arrivals are higher compared to last year. According to the Pakistan Cotton Ginners’ Association (PCGA), arrivals of cotton as of September 15, 2023, increased by 80% to 3.93 million bales compared to 2.19 million bales during the same period last year, recovering from the devastating floods that affected cotton production last year.

On the external front, the finance ministry anticipates an increase in foreign remittances due to military-driven actions against speculative activity in the foreign exchange market. This crackdown is expected to have a positive impact on remittances, trade, and the current account balance.

Furthermore, Pakistan’s main export markets, particularly the US, the UK, the Euro Area, and China, are showing positive trends in trade, indicating prospects for export growth in the coming months. However, imports are expected to gradually increase to stimulate economic activities, which may keep the current account within sustainable limits, according to the finance ministry.

The finance ministry expressed satisfaction with the fiscal performance thus far and expects that the economic revival plan and prudent actions, including policies such as Special Investment Facilitation Council (SIFC) and IT policy, will attract new investments, creating a multiplier effect for higher and more inclusive economic growth in FY2024 and beyond.

The current account posted a deficit of $935 million for July-August FY2024, compared to a deficit of $2 billion in the previous year, largely reflecting an improvement in the trade balance.